Mastering the Accounting Cycle: A Step-by-Step Guide

Double-entry bookkeeping calls for recording two entries with each transaction in order to manage a thoroughly developed balance sheet along with an income statement and cash flow statement. Closing accounts is the last step, where you have to close all temporary accounts such as expenses and revenues (mostly income statement items) to retained earnings and owner’s equity account. This is very essential step to restarting your accounting cycle for the next accounting period. Once the company has adjusted all the entries as necessary, you can create financial statements. Most businesses generate balance sheets, income statements and cash flow statements.

Small Business Resources

You can do this in a journal, or you can use accounting software to streamline the process. Once a transaction is recorded as a journal entry, tax calculator return and refund estimator 2020 it should post to an account in the general ledger. The general ledger provides a breakdown of all accounting activities by account.

Using financial insights to maximize your business potential

This allows a bookkeeper to monitor financial positions and statuses by account. One of the most commonly referenced accounts in the general ledger is the cash account which details how much cash is available. With double-entry accounting, common in business-to-business transactions, each transaction has a debit and a credit equal to each other. It gives a report of balances but does not require multiple entries.

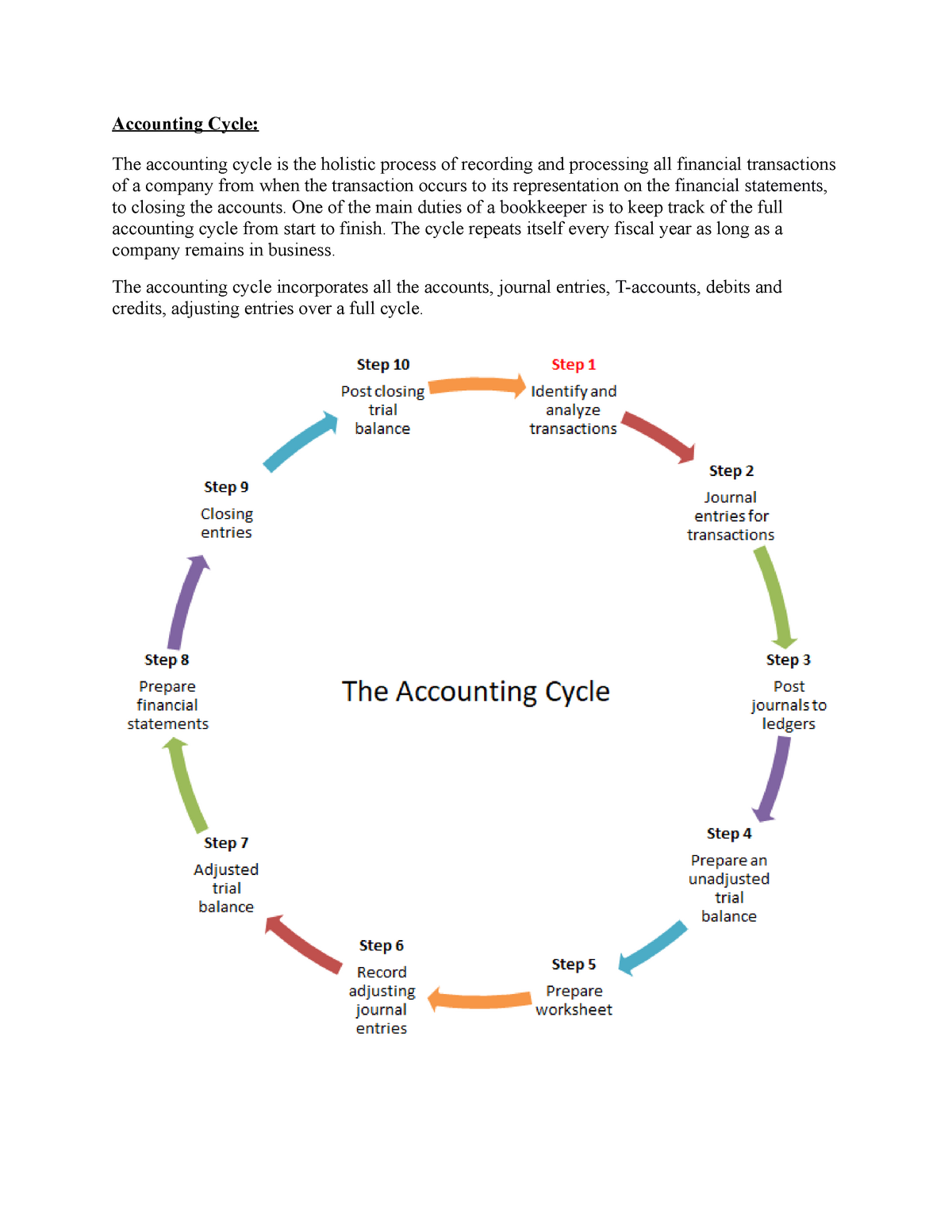

- The accounting cycle is a comprehensive process designed to make a company’s financial responsibilities easier for its owner, accountant or bookkeeper to manage.

- To gain a better understanding of this, consider an error in the general ledger.

- This is a straightforward guide to the chart of accounts—what it is, how to use it, and why it’s so important for your company’s bookkeeping.

- Barbara has an MBA from The University of Texas and an active CPA license.

- She is a Xero Advisor Certified and Remote Account Assistant, where she prepare monthly financial reports for the clients.

Journalizing:

She is a former CFO for fast-growing tech companies with Deloitte audit experience. Barbara has an MBA from The University of Texas and an active CPA license. When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. Accruals have to do with revenues you weren’t immediately paid for and expenses you didn’t immediately pay. Think of the unpaid bill that you sent to the customer two weeks ago, or the invoice from your supplier you haven’t sent money for. If you use accounting software, this usually means you’ve made a mistake inputting information into the system.

Closing:

Thus, staying organized throughout the process's time frame can be a key element that helps to maintain overall efficiency. Most companies seek to analyze their performance on a monthly basis, though some may focus more heavily on quarterly or annual results. The accounting cycle is a methodical set of rules that can help ensure the accuracy and conformity of financial statements. Computerized accounting systems and the uniform process of the accounting cycle have helped to reduce mathematical errors.

Steps in accounting cycle

It is important that these transactions are identified as they occur. While this used to be done manually, accounting software now makes this task easy. What was once difficult to stay on top of is now easy for anyone to manage. From the meticulous input of financial data to the generation of reports, the accounting cycle ensures a systematic approach to maintaining financial records.

The eight-step accounting cycle is important to know for all types of bookkeepers. It breaks down the entire process of a bookkeeper's responsibilities into eight basic steps. Many of these steps can be automated through accounting software and other technology, including artificial intelligence. However, knowing the steps and how to complete them manually can be essential for small business accountants working on the books with minimal technical support. It's important because it can help ensure that the financial transactions that occur throughout an accounting period are accurately and properly recorded and reported. This can provide businesses with a clear understanding of their financial health and ensure compliance with federal regulations.

An adjusted trial balance may be prepared after adjusting entries are made and before the financial statements are prepared. This is to test if the debits are equal to credits after adjusting entries are made. Cash accounting requires transactions to be recorded when cash is either received or paid.

Generally accepted accounting principles (GAAP) require public companies to use accrual accounting for their financial statements, with rare exceptions. The accounting cycle focuses on historical events and ensures that incurred financial transactions are reported correctly. Meanwhile, the remaining five steps are the bookkeeping tasks you do at the end of the fiscal year.